Bitcoin and subsequent blockchain technologies have established a new asset class in which scarcity is based on cryptographic certainty. With these trust protocols for the internet, digital assets can be created, issued, and transmitted for the first time. Venox is an investment firm committed to exceptional returns for investors through actively managed portfolios of these blockchain assets.

The information on this website is for discussion purposes only and does not constitute an offering. Access to Venox private client services is only available via invitation to appropriate investors. Digital asset prices are volatile and past performance is no guarantee of future results.

Venox maximises security while minimising impact on the environment, thanks to our partnership with Moss→.

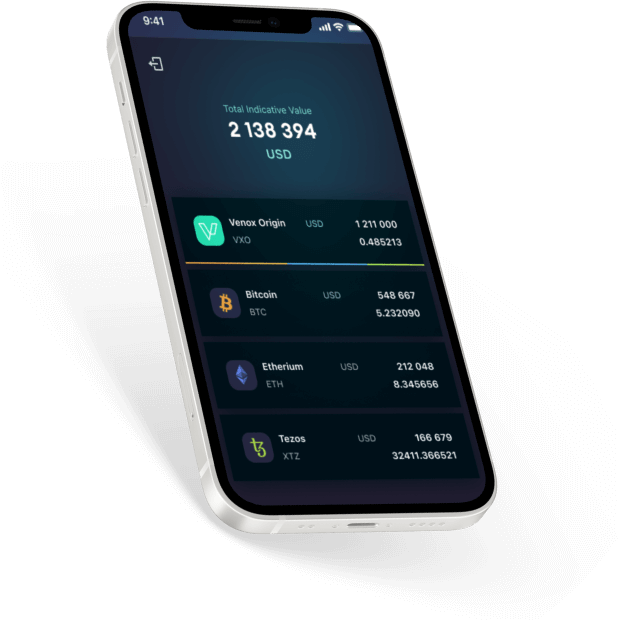

Invited investors have exclusive access to the Venox app and platform for tracking portfolio performance.

Venox has drawn on our founders' experience dating back to the dawn of the digital asset industry to develop a range of secure and private digital asset investments that minimise costs and keep pace with the latest advances in digital assets.

Our vaults offer the ultimate in secure custody for digital assets, while our managed portfolios offer rational diversification into a hand-selected group of top-performing assets.

An efficient investment strategy that focuses on foundational, Layer 1 digital assets provided by Inves Capital.

Carbon neutral

in partnership

with MOSS

The Origin managed portfolio holds a basket of digital assets selected by the Inves Capital research team to offer asymmetric returns through economically-sound narratives.

Venox single-asset custody vaults secure digital assets with offline cryptographic keys held in physical subterranean storage provided by Inves Capital, traditionally used for bullion vaulting.

Safely store digital assets and withdraw at any time.

Venox puts security and privacy first in protecting value for our clients. We have created a robust protocol for securing digital assets using offline, physical vault infrastructure on two continents, and drawing from our deep experience in the industry.

The Venox Origin portfolio has substantially outperformed the S&P 500 and general digital asset market by leveraging our research in and experience with the industry-leading digital assets.

Optimised to maximise returns without forgoing privacy or security, our private client vaults and portfolios offer the ultimate strategy for investing in digital assets.

The price of Digital Assets is highly volatile, for example it may rapidly go down or up on any given day, including on an intraday basis. Investments in Digital Assets are deemed high-risk speculative investments and there is a risk of total material loss. Speak to your financial advisor before making any investment into digital assets.

Venox in partnership with MOSS offsets all carbon produced by digital assets stored for our clients with the Moss Carbon Credit (MCO2) token.

One MCO2 Token equals one carbon credit from a VCS certified environmental project including forestry, energy, biomass, and others. The MCO2 Token democratises carbon offsetting and massively increases funding for the conservation of the environment and for greenhouse gas emission reduction.

Learn more about Moss and its projects at https://moss.earth and read more about our partnership on the Venox blog.